Insurance Unassured – Park Insurance Woes

Caravan Parks are pulling out some of their Family and Leisure equipment. Here’s why.

Any business needs some form of insurance. It might be on the buildings, contents, public liability, close of business–the options are endless. Except when they’re not.

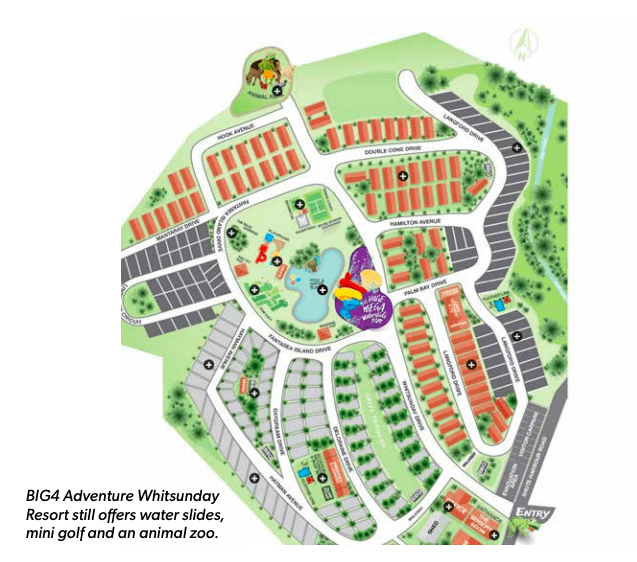

BIG4 Adventure Whitsunday was started by Greg McKinnon’s parents over 30 years ago and he has continued to build it up to be the park that they dreamed of. The park is huge, with lots of cabins and sites. But a holiday park needs to have activities and play facilities to keep the whole family entertained.

Greg has discovered, the hard way, that one year’s insurance doesn’t mean you will get it the next year.

No Jumping Pillows?

If you have been to his park recently you will see a large sign explaining why two giant sized jumping pillows are no longer there. According to Greg, it was quite simple. He was told “If you want insurance, you won’t get it if you keep the Jumping Pillows.”

The jumping pillows had to be removed. This wasn’t an easy decision because, as any park operator with jumping pillows knows, they are a major attraction for kids. They can jump and jump all day and sleep the sleep of-the-jumped-out all night!

Making the decision was one thing, affording the insurance was eye watering. Even with the jumping pillows removed his annual insurance premium went from $265,000 to $940,000. But why was he given that impossible choice?

“A Small Player”

Let’s look at the Insurance Industry in Australia.

In the global scheme of Insurance, Australia is a small player:

• It’s a huge country with a small population

• Huge contrasts in weather and conditions

• There’s insufficient capital to underwrite all the insurance policies issued in Australia

• Extra underwriting is done through Lloyds of London

• Australia is the fourth largest market for Lloyds

The Climate Factor

Lloyds of London have conducted in-depth risk reviews, mostly concentrating on Climate Change and how their Managing Agents are dealing with risks under Climate Change. Recent catastrophes include. 2019 BUSH FIRES–the Royal Commission into National Natural Disaster Arrangements published the 2019-2020 Bushfire History Project in October 2020. 2022 FLOODS–Insurance Council of Australia have a Data Hub with information on a range of catastrophes including the 2022 Floods. Drought is still on-going in areas of low rainfall.

Business Benefits

Greg and Insurance Companies have one thing in common. They are all running a business to make a profit, not a loss. The amount of profit is something else. But, before you say anything about greedy insurance companies, check your share portfolio or superannuation plan to see if you are gaining because insurance makes a profit.

Where to from here? What can a business like a Caravan Park do to keep operating if insurance is too hard to get, or a huge impossible cost?

Adults behaving! Greg told me that he has never had a claim against his insurance because of a jumping pillow accident. However, I have been told by an Insurance insider that the number of claims on Jumping Pillows has increased, not because of kids, but because of adults using the equipment they are not supposed to.

Industry Responds

The peak body for the Caravan Industry represents all aspects of the industry, manufacturers, caravan parks, play equipment, camping supplies etc. I spoke with Stuart Lamont, CEO of Caravan Industry Association of Australia about this situation.

Q. Could the peak body find a way to arbitrate between the industry segments and Insurance companies?

“The caravan industry is not the only sector struggling for insurance. Amusement parks, tourism businesses and those businesses in flood, fire or cyclone risk areas all have been impacted by global insurance nervousness and rebalancing of their portfolio. “We have been working hard to lift the profile of the plight of caravan parks, but it is a complex problem. Two solutions which do exist revolve around group buys or a diversified mutual fund (DMF) / captive insurance model. Both risk distorting the market and while a DMF seems the easiest solution it is challenged by its lack of recognition within the financial sector to satisfy financial covenants. “Add to this the challenges associated with workers compensation rules across states and the public liability chestnut is also a hard nut to crack.”

Industry Responds Cont.

Q. Who can contribute to a risk review?

“There have been several reviews conducted recently by the Small Business Ombudsman into the insurance problem, however solutions are not easy. We have been part of a number of working groups looking towards solutions, but sadly nothing has come of this yet. We are talking to The Insurance Council of Australia at present regarding how we can assist in risk mitigation strategies as part of a new Committee which is looking to be set up to look into the matter.”

Q. How can park operators mitigate risk?

“This is something we are in discussions with the insurance industry at present– that being said, in some cases it is not the equipment itself which poses the risk but rather the behavior of guests using these products, and the legal system which overprotects reckless behavior. There must be a fine balance between the park doing everything they can to mitigate risk of injury, and guests using these products responsibly.

“Where we can establish some further best practice guides around risk management we will certainly introduce these into the caravan park accreditation program so that hopefully facilities which are much loved by caravan park guests can continue to be covered by insurance and remain available to use.”

Long Term?

Long Term?

Greg is not on his own with removing equipment. Other people on other parks are facing the same impact. Play equipment is being, or has been, removed. Beautifully designed resort style swimming pools may well turn into rectangular pools with cameras on each corner. As the cost of Insurance rises due to the perceived increase in risk, there is only one way for that cost to be found. An increase in fees.